Free Online Productivity Tools

i2Speak

i2Symbol

i2OCR

iTex2Img

iWeb2Print

iWeb2Shot

i2Type

iPdf2Split

iPdf2Merge

i2Bopomofo

i2Arabic

i2Style

i2Image

i2PDF

iLatex2Rtf

Sci2ools

116

click to vote

Book

Steven Shreve: Stochastic Calculus and Finance

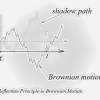

This is a great draft book about stochastic calculus and finance. It covers large number of topics such as Introduction to Probability Theory, Conditional Expectation, Arbitrage Pricing, The Markov Property, Stopping Times and American Options, Stopping Times and American Options, Properties of American Derivative Securities, Jensen’s Inequality, RandomWalks, Pricing in terms ofMarket Probabilities: The Radon-Nikodym Theorem., Capital Asset Pricing, General Random Variables, Semi-Continuous Models, BrownianMotion, The Itˆo Integral, Itˆo’s Formula, Markov processes and the Kolmogorov equations, Girsanov’s theorem and the risk-neutral measure, Martingale Representation Theorem, A two-dimensional market model, Pricing Exotic Options, Asian Options, Summary of Arbitrage Pricing Theory, Recognizing a BrownianMotion

An outside barrier option, American Options, Options on dividend-paying stocks

Bonds, forward contracts and futures, Term-structure models, Gaussian processes

Hull an...

| Added | 17 Jan 2009 |

| Updated | 14 Aug 2009 |

| Authors | Prasad Chalasani, Somesh Jha |

Comments (0)